Own Your Own Home

Habitat for Humanity partners with families in Prince Edward and Hastings Counties to provide them with affordable homeownership opportunities.

Note: Our application process typically takes several months and waiting for a home to be funded and constructed can take up to two years or more. Our current programs are not designed to provide housing for emergency situations. If you have an emergency housing crisis, we encourage you to contact the Hastings Housing Resource Centre as a starting point: https://hastingshousing.com/community-connections/

our current build

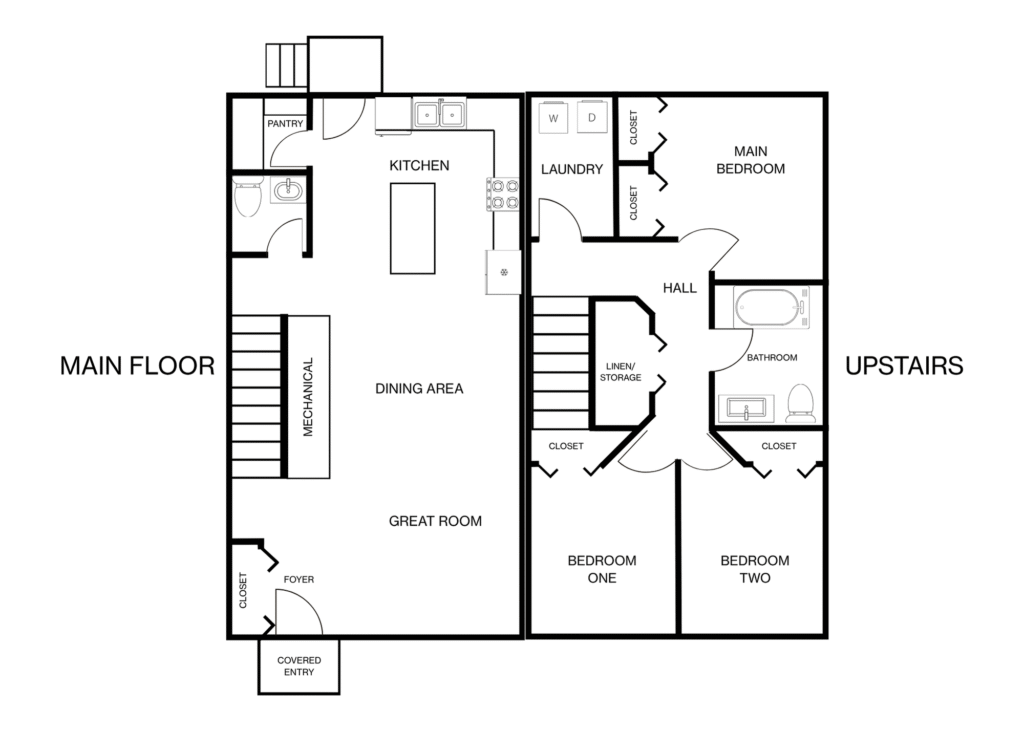

Our current build is on Lester Road in Quinte West. Two semi-detached 3-bedroom homes, for a total of four units will be constructed starting in the fall of 2025. The following example floor plan shows both the main floor and upper floor for one unit. For more details about how to apply, continue reading below. Note, these units will have unfinished basements with rough-ins for a third bathroom.

This project brought to you by:

you could be our next homeowner

Have you been trying to own your own home, but despite all your hard work, are unable to save enough for a down payment to qualify for a conventional mortgage? You may be able to join our homeownership program.

We partner with families, couples and individuals in the counties of Hastings and Prince-Edward to help them buy their own homes through Habitat’s one-of-a-kind homeownership program.

Homeownership is a big process and a big decision. Habitat homeowners pay an affordable mortgage for their home. This can often be lower than their rent prior to joining the program! To learn more about how mortgages work, visit Canada’s Mortgage education page.

how we select our families

Our program is built upon three key pillars:

Affordable Housing Need

- Can’t qualify for a traditional mortgage

- Currently living in unsafe, unsuitable, or unaffordable housing

Ability to Pay

- Have a stable, consistent source of income sufficient to cover the cost of homeownership (remember, owning a home is the beginning of the journey, not the end!)

- Must have a good credit score

- Cannot have payments currently in collections, or an overwhelming amount of debt.

- Any bankruptcy or consumer proposals must have been discharged at least 3 years prior to application

- All household members must be citizens or permanent residents of Canada, and have lived in Hastings or Prince-Edward counties for at least 2 years

Willingness to Partner

- Homeownership is a big step! Families we partner with must be willing and ready to accept the responsibilities of being a homeowner, including but not limited to: utilities, insurance, property taxes, maintenance, and other expenses that may come up from time to time.

- Part of our program included education and guidance in how to maintain your home, and budget for long term expenses. Participation in this is required.

- Our homeownership program also requires that all homeowners agree to be good neighbours. You need to be willing to work towards building good relationships with volunteers, donors, community members, and your new neighbours.

- You also need to be willing to be a positive partner with Habitat. All homeowner families must complete 500 hours of community service; in support of the build of their own home, Habitat, and the community at large.

Does this sound like you? If so, read on to see the steps of the application process!

Habitat for Humanity Prince Edward-Hastings commits to:

- Ensure that all Applicant Families understand the application and selection process;

- Ensure that Applicant Families understand the full scope of partnership;

- Ensure Applicant Families understand timelines, expectations, roles, and responsibilities;

- Communicate within a reasonable timeframe with Applicant Families regarding the status of their application;

- Ensure the selection process is non-discriminatory and aligned with the protected grounds of the Canadian Charter of Rights and Freedom;

- Maintain an environment of strict confidentiality, and;

- Once selected for the program, provide Habitat homeowners a mutual support system, educational opportunities, and a form for discussions pertaining to home ownership and maintenance, all for the purpose of helping families to break the poverty cycle and become independent.

Application Process

Individuals and families interested in applying for the program must fill out the Expression of Interest on our website (see Click Here button below). This initial information will support determining the applicant’s ability to pay and affordable housing need (see above). Applicants (and/or Co-Applicants) must be Canadian citizens or permanent residents of Canada and have been free from bankruptcy (if applicable) for the past 3 years or more.

Applicants that meet the initial qualifications from Step 1: Expression of Interest, will be emailed to complete a more thorough application through our partner VeriFast. Habitat for Humanity requires applicant families to understand the financial commitment they are undertaking by becoming a Habitat homeowner. Through the application on VeriFast, Habitat Prince Edward-Hastings will be able to verify if an Applicant’s income is within range to afford a fair market value home. Even though our mortgages require no down payments and charge a preferred interest rate, they will still require your family to carry payments that will be 25% of your gross family income (line 15000 on your Notice of Assessment). Any applicant 19+, and not in school must declare their income. The Habitat for Humanity homeownership program is a hand up; not a handout. Habitat Prince Edward-Hastings will also calculate the following: your gross debt service ratio (projected mortgage payment, property tax, insurance = 30-35% of gross income), and your gross debt service ratio (same, plus addition of other debt obligations = no more than 42% gross income). These calculations are to determine if an Applicant’s family can carry the load of the mortgage without overwhelming them financially. There will also be documents an Applicant’s family is required to upload. The following documents may be required:

Applicants who have had their financial assessment determined as meeting the necessary criteria will be invited to attend an information session run by Habitat Prince Edward-Hastings. These sessions will act as an introduction to Habitat for Humanity, its policies, and our partner RBC Mortgage Specialist. Attending a scheduled Info Session is a MANDATORY part of the application process. Any invited Applicant Family who does NOT attend an Info Session will be considered denied as a potential Habitat Homeowner. During the session, the Applicant Family will book a time with RBC to complete a credit check. The Info Sessions will also cover topics such as, what the next steps in our application process require, as well as what happens when an Applicant is successful. We will also explain important parts of the Habitat for Humanity program, such as Volunteer Hours and Homeowner Education, and cover our mortgage model.

From the completed credit checks, selected candidates will be asked to set up a time for a Home Visit, for a final review of the application information. Having representatives from Habitat Prince Edward-Hastings visit your current home will support the finalized report (see Step 5) and give an opportunity for the Applicant Family to clarify any lingering questions. The representatives will also discuss with the Applicant what it means to partner with Habitat Prince Edward-Hastings, including their ability to complete the required 500 Volunteer Hours (see Step 8). Receiving Habitat Staff for a Home Visit is MANDATORY to be considered as a potential Habitat Homeowner, and any Applicant Family that declines will be considered denied as a potential Habitat Homeowner.

The Family Selection Working Group will compile data from the Expression of Interest (Step 1), Financial Assessment (Step 2), and the Home Visit (Step 4), into a final total for each Applicant Family. The totals for all Applicant Families will be compared, considering (but not limited to): their current housing being unsafe/unhealthy, being precarious/not a long-term solution, not being suitable for the family make-up, and/or costing more than 30% of a family’s gross income. Then the Family Selection Working Group will present the successful Applicant(s) to the Habitat Prince Edward-Hastings Board of Directors (see Step 6).

The Habitat Prince Edward-Hastings Board of Directors will approve the Family Selection Working Group’s recommended Applicant Family for Homeownership.

The successful applicant(s) will become a future Habitat Homeowner(s). This decision will first be communicated to the Applicant Family, and they will be given the opportunity to accept. Applicant(s) who are not selected are kept on file for one year, and encouraged to re-apply if/when applications are opened again, with updated financial information.

As HFHPEH’s future Habitat Homeowner(s) we require:

2 parent families – 500 hours total

Single Parent Families – 500 hours Total

Adult Applicants

250 MIN

*Up to 80 MAX can be considered to be transferred from other qualified non-profits

*150 hours MUST be contributed to ReStore

Relatives & Friends

250 MAX

25 MAX of Child Care for Applicant (Children 12 or under)

*While Applicants complete their hours

Children 16 & under

Half Value

+10 for 85% (or above) school attendance

*Separate from required community service hours

Adult Applicant

150 MIN

*Up to 80 MAX can be considered to be transferred from other qualified non-profits

*100 hours MUST be contributed to ReStore

Relatives & Friends

350 MAX

25 MAX of Child Care for Applicant (Children 12 or under)

*While Applicants complete their hours

Children 16 & Under

Half Value

+10 for 85% (or above) school attendance

*Separate from required community service hours